Can a foreigner get a home mortgage in Italy?

Foreigners can obtain a home mortgage in Italy as long as they have sufficient and demonstrable regular income. Italian banks will generally prefer to lend to those who are resident in Italy, or will become resident in Italy. The conditions for non-residents will generally be less favorable, e.g. instead of the normal 80% of "loan to value, (ltv)" (the lessor of bank's appraised value and sale price), it would be more like 40 - 60%. Note that each bank determines their own lending policies and these policies may change from time to time: what is true for one bank is not necessarily true for another bank.

Is there a minimum mortgage loan amount in Italy?

Most Italian banks will not want to lend a small amount, as their costs to initiate and manage the loan may be greater than their profit overtime. Expect the minimum loan amount to be around € 50,000.

What is the tax on an Italian mortgage?

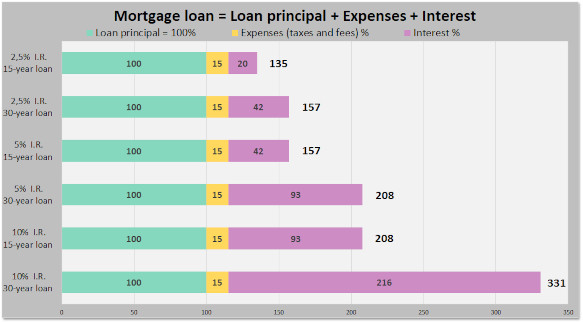

Beyond bank loan initiation fees and insurance costs, the Italian state taxes mortgages at 0.25% if the mortgage is for a primary home and at a hefty 2% if the mortgage is for a second home. There is also additional legal cost (the notaio fee) for the mortgage contract and lien put on the property.

Does mortgage preapproval exist in Italy?

Many Italian banks now offer the possibility to obtain a mortgage preapproval, called a predelibera, which determines how much the bank will lend the borrower based on the borrower's credit profile. A credit profile may consider factors such as assets, wage history, employment history and age. As banks have marketing departments which work tirelessly day in day out to convince us they're offering products, not services (banks don't have products), among other things, it is worth noting that each bank has its own tedious cutesy name for a pre-approval. Intesa Sanpaolo will speak of "Mutuo in Tasca" (feel free to correct them by using the term predelibera!). Unicredit now speaks of valutazione preliminare (having used voucher mutuo in the past). A mortgage preapproval will be valid for a limited time, such as 6 months or so. Preapproval is independent of a specific real estate property, i.e. home. The actual loan amount will also depend on the bank's appraisal of the property and the sale price.

Should I use a mortgage broker to obtain an Italian mortgage?

In most cases the best solution is to go directly to a local bank branch directly, perhaps taking a friend or real estate agent along should language be a problem. Brokers will add additional cost without necessarily providing value. Do keep in mind brokers need to be certified and licensed. Many serving the international community are not and will swear until they're blue in the face that licensing doesn't apply to them. Caveat emptor.

Do I need to be present to obtain an Italian mortgage?

Most Italian banks have automated their processes: there is the expectation that the borrower will be present to initiate the loan, possibly signing using a "Wacom" type electronic signature pad. The borrower would probably also need to be present in the rare case the initial loan request needs to be modified before the disbursement of funds. It is unlikely the bank would be enthusiastic about working with a power of attorney.

Is Home Insurance required for an Italian Mortgage?

The lending bank will generally require the borrower to have an insurance policy covering fire and explosions for the life of the loan: the bank wants to protect its collateral. The bank will offer a policy but the borrower is also free to choose others. In most cases the borrower should supplement the base policy with more extensive home owner's insurance coverage to cover damage to third parties and the contents of the home.

Will a foreign bank provide financing for a home in Italy?

Generally no, as the foreign bank needs to have contacts in Italy to place and remove a lien on the property in Italy. Some banks in Germany have offered mortgages in Italy in the past.

Why did a major Italian bank say they won't lend to me?

It can occur that a specific clerk says their bank won't lend to foreigners even when this is not the banks policy. The clerk may not be well-informed or perhaps isn't interested in taking on complexity. Try speaking to a different clerk.

What other home financing schemes exist in Italy?

Seller financing is a possibility. A rent to own scheme is codified in law. Few sellers will be interested in providing buyer financing.

❖ ❖ ❖

The above is offered as general guidance without warranty; changes may have occurred since it was written. Do consult with appropriate qualified professionals regarding your specific situation before making any real estate purchase.

About the author

Sean Michael Carlos grew up in Rhode Island, USA. He studied in the US, UK and Germany before settling in Italy where he has lived for over twenty-five years, in three different regions.

Sean is a licensed real estate agent in Italy with over 10 years experience in the sector and would love to hear from you if you are looking to buy or sell property in Italy.